Yesterday, a former Commisisoner for Finance in Abia State, Hon. Obinna Oriaku issued a statement captioned “ALEX Otti ADMINISTRATION AND THE ROT IN ABIA REVENUE SYSTEM: WHEN GOVERNANCE BECOMES a TOOL FOR VENDETTA”.

Hon. Oriaku narrated what transpired between him and some staff of the Abia State Board of Internal Revenue (BIR) when he went for his tax clearance and gave the false impression that the Board treated him unfairly because of who he is.

The claims by Mr. Oriaku are untrue and utterly malicious.

From all indications, Mr. Oriaku was more interested in blackmailing Governor Otti and his government with a view to attracting sympathy and positive publicity to himself than telling Abians the truth of what transpired.

The facts as verifiable are as follows:

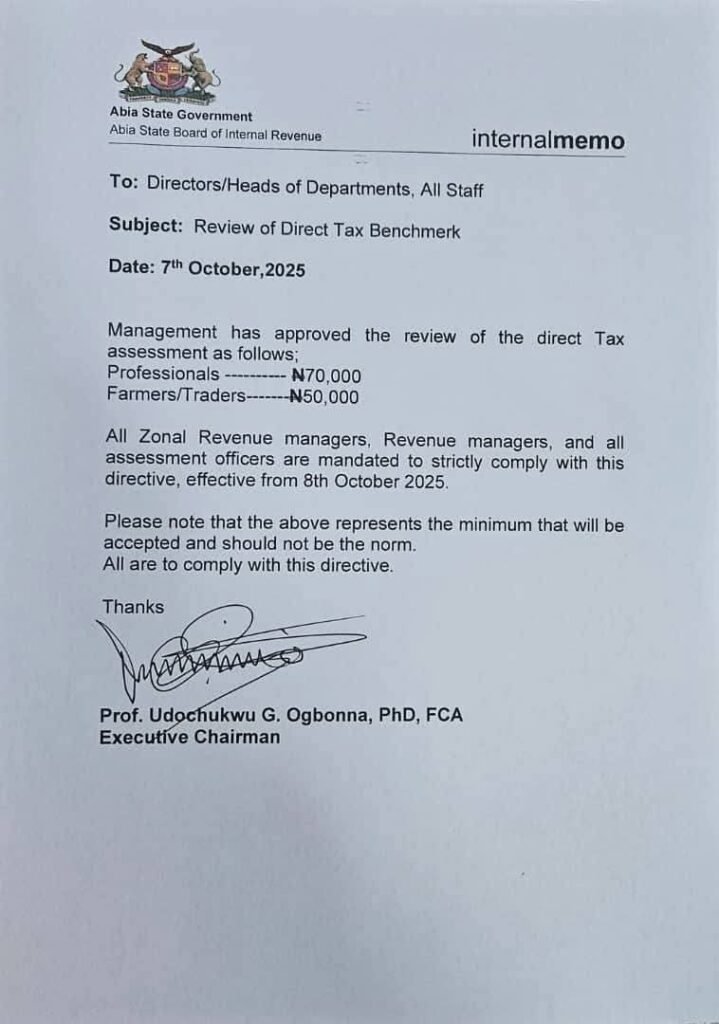

- The Circular by Abia State government through the BIR that pegged annual tax return for Traders at 50,000 naira and Professionals/ Politically Exposed Persons(PEP) at 70,000 naira, clearly indicated the aforementioned amounts as MINIMUM. We challenge anyone to present a contrary evidence.

- When a citizen comes for tax clearance, he or she is further interrogated by tax administrators at BIR to establish the right amount they are supposed to pay. This is a standard practice across the federation.

- Hon. Obinna Oriaku was respectfully and fairly subjected to this practice and was asked the following questions:

(A) What do you do for a living? His response was; I am jobless?

(B) How do you earn income? His response was; I’m selling my properties.

(C) How much have you earned from such sales? He refused to respond to this question and every other question put across to him.

In a situation like this, the law authorises the Board of Internal Revenue to carry out what is called “Administrative Assessment” or “Best of Judgement” to determine what should be charged the person. It was on the strength of this assessment that the Board requested Hon. Oriaku to pay the sum of N483,000.

- Hon. Oriaku ran to Enugu and met with his former colleague who is now the BIR Chairman. He told the Enugu BIR Chairman that he needed a tax clearance to enable him go for Senate Screening but that he didn’t have enough money for the tax clearance and requested for his assistance. The BIR Chairman asked him how much he could pay and he said N100,000. The BIR Chairman asked his staff to collect N100,000 from him. This was a gesture of generosity extended to him by a former colleague on the grounds that he had no money, not because it was what he was supposed to pay.

- Hon. Oriaku knows that tax in Enugu at the moment is more than three times of what is collected in Abia. This is verifiable and that was why he initially didn’t want to do it in Enugu. Also, he never disclosed to his former colleague what transpired in Abia before he ran to him.

- Does it show that Hon. Oriaku is an honest and responsible citizen when he expects Abia State government to collect the sum of N70,000 annually as his tax?

- We challenge Hon. Oriaku at this point to publish his 2024 annual income to prove to the world that Abia State Government is unfair to him by demanding that he pays the amount charged him following his refusal to disclose his income. This will enable the government to apologise to him publicly and pay the real amount on his behalf if it is established through such a publication that the government erred. Failure to do this, we would expect him to be honourable enough to apologise to Abians and other members of the public for lying against the government and for trying to deceive the public.

- Finally, it’s important to remind Hon. Oriaku and other persons indulging in this kind of politics that Abia State government is not interested in trivialising or politicising important and sensitive issues bordering on governance and development of the state, hence our appeal to him to refrain from raising false alarms and discrediting key government institutions. The government has nothing personal against him and doesn’t see him as an enemy or a threat in any way.

He should be a responsible citizen by going to pay his taxes, especially when he is enjoying the massive dividends of democracy which the Otti government has brought to his doorstep.

Ferdinand Ekeoma

Special Adviser to the Governor

(Media and Publicity)

October 24, 2025.